|

|

||||

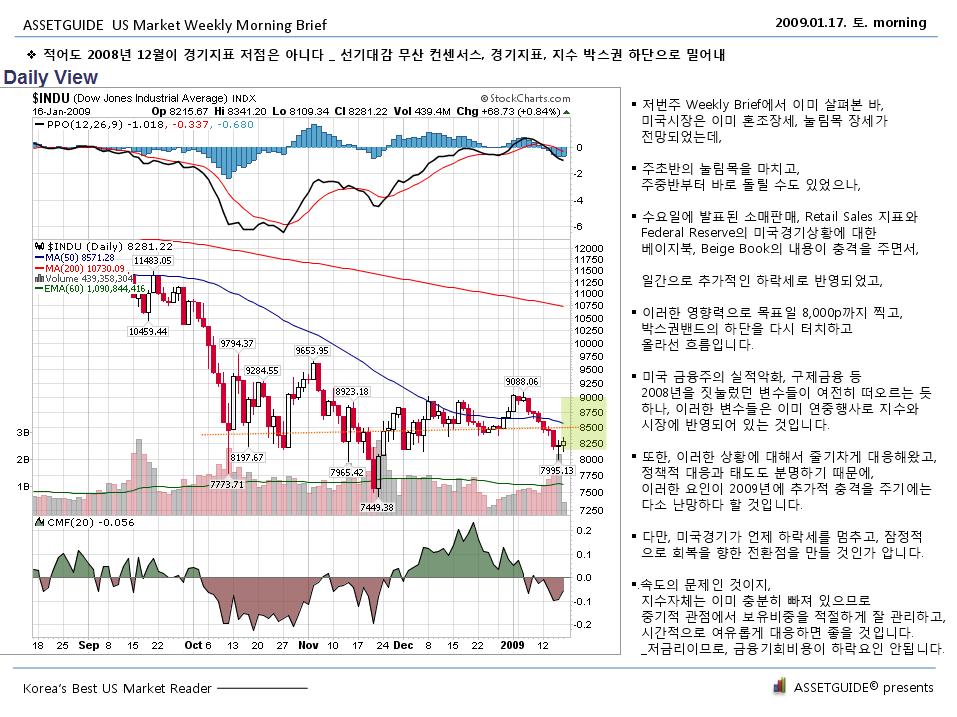

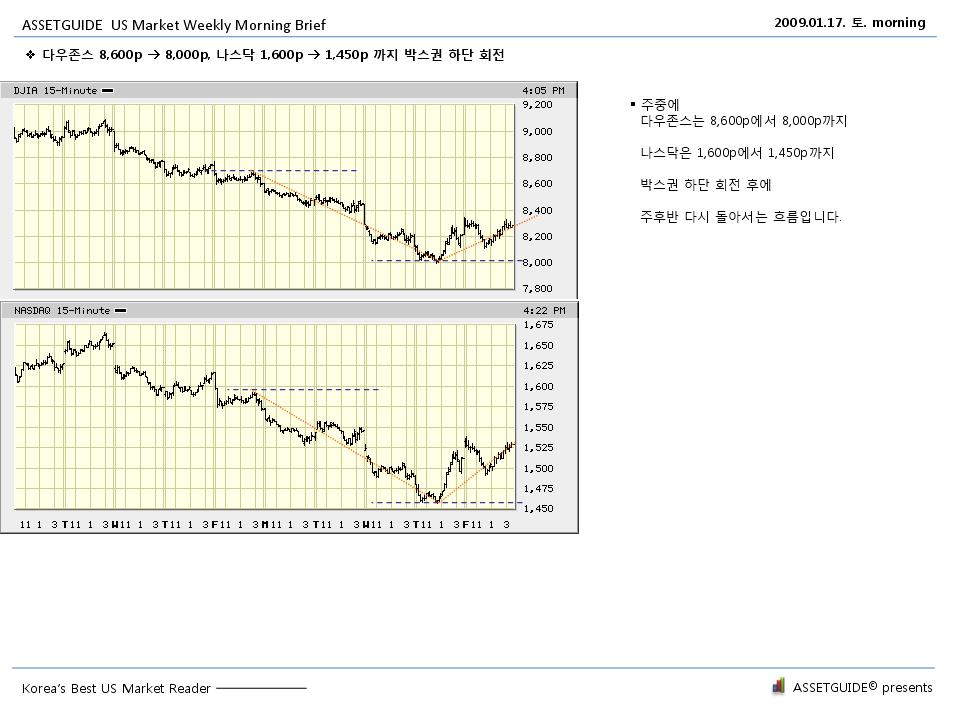

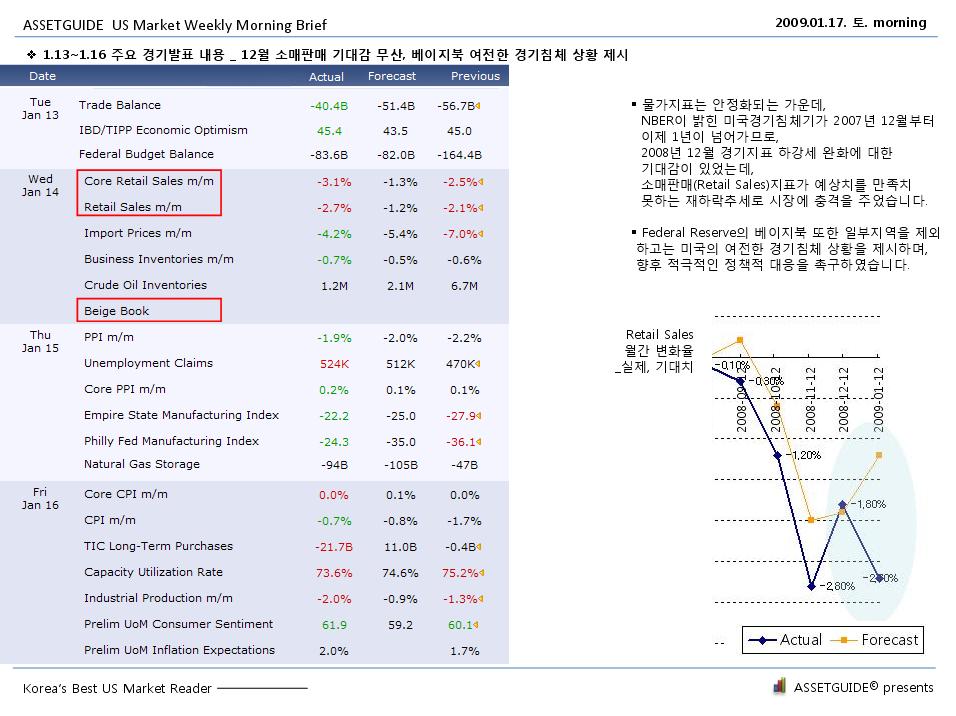

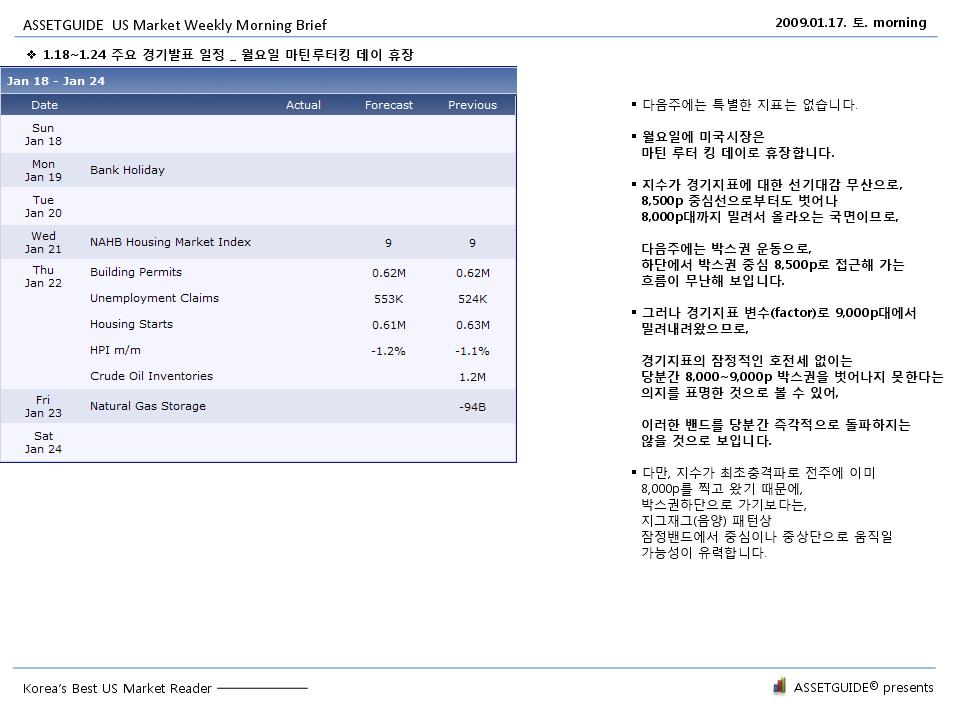

2009년의 마지막 베이지북인 12월호 Beige Book이 12월 2일 (현지) 발표되었습니다.

베이지북(Beige Book)은 미국의 경제상황, 경기동향을 보여주는 대표적인 지표로 FRB가 연간 8회 작성하여 공개합니다.

2009년 12월 2일 발표된 베이지북은 올해의 마지막 발간호입니다.

이번 베이지북에서 FRB는, 저번 보고서와 마찬가지로,

미국 경기 상황이 점차로 회복되고 있음을 밝히고 있습니다.

소비자 소비, 제조업이 점차 개선되고 있으며, 부동산 경기도 약세이지만 안정화되는 추세를 보이고 있음을 밝혔습니다.

한편, 임금이나 물가 지표는 안정화되어 있으나, 고용은 여전히 약세이고, 상품(commodity) 물가는 상승의 조짐이 있다고 지적했습니다.

부동산 부문을 보면, 주택시장은 개선의 조짐이 엿보이나, 상업용 부동산 시장은 여전히 침체해 있다고 보고했습니다.

이 자료는 미국 경제상황을 보여주는 핵심지표로, 연방준비은행 FRB (Federal Reserve Bank)가 발표합니다.

이들 12개 지역은 Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, San Francisco 입니다. (보스톤, 뉴욕, 필라델피아, 클리브랜드, 리치몬드, 아틀란타, 사카고, 세인트루이스, 미네아폴리스, 캔사스시티, 댈라스, 샌프라시스코)

2010년의 첫 발간물이 될 다음 베이지북은 2010년 1월 13일(현지)에 발간됩니다.

첨부 : FRB 베이지북 보고서 전문 파일 (2009.12.02 Beige Book)

Prepared at the Federal Reserve Bank of New York and based on information collected on or before November 20, 2009. This document summarizes comments received from businesses and other contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials.

전문 요지

Reports from the twelve Federal Reserve Districts indicate that economic conditions have generally improved modestly since the last report. Eight Districts indicated some pickup in activity or improvement in conditions, while the remaining four--Philadelphia, Cleveland, Richmond, and Atlanta--reported that conditions were little changed and/or mixed.

경기 상황이 점차로 개선되고 있다.

Consumer spending was reported to have picked up moderately since the last report, for both general merchandise and vehicles; a number of Districts noted relatively robust sales of used autos. Most Districts indicated that non-auto retailers were holding lean inventories going into the holiday season. Tourism activity varied across Districts. Manufacturing conditions were said to be, on balance, steady to moderately improving across most of the country, while conditions in the nonfinancial service sector generally strengthened somewhat, though with some variation across Districts and across industries. Residential real estate conditions were somewhat improved from very low levels, on balance, led by the lower end of the market. Most Districts reported some pickup in home sales, though prices were generally said to be flat or declining modestly; residential construction was characterized as weak, but some Districts did note some pickup in activity. Commercial real estate markets and construction activity were depicted as very weak and, in many cases, deteriorating.

소비자 소비, 제조업 조건이 개선되고 있다.

Financial institutions generally reported steady to weaker loan demand, continued tight credit standards, and steady or deteriorating loan quality. In the agricultural sector, the fall harvest was delayed in the eastern half of the nation due to excessively wet conditions during October and early November. Most energy-producing Districts noted a slight uptick in activity in the sector since the last report. Labor market conditions remained weak since the last report, though there were signs of stabilization and scattered signs of improvement. While some Districts reported upward pressure on commodity prices, they saw little or no indication of upward wage pressures or of any significant increase in prices of finished goods.

부문별 내용

Consumer Spending and Tourism 소비자 소비, 관광업

Consumer spending strengthened since the last report, with sales of both general merchandise and autos improving across much of the country. Non-auto sales were reported to have picked up in the New York, Philadelphia, Cleveland, Richmond, Atlanta, Kansas City, and San Francisco Districts; sales were described as steady or mixed in the Boston, Chicago, Minneapolis, and Dallas Districts. St. Louis described retail sales as below expectations and down from a year earlier. Auto sales generally improved since the last report, in some cases rebounding from a brief dip after the "cash-for-clunkers" program ended. Increased vehicle sales were reported from New York, Philadelphia, Richmond, Chicago, St. Louis, and Dallas, while sales were described as flat or mixed in the Cleveland, Minneapolis, Kansas City, and San Francisco Districts. A number of Districts reported that used vehicles have been selling better than new ones.

Most Districts also noted that retailers were holding leaner inventories this holiday season, though some indicate that retailers have recently become more optimistic about the holiday-season outlook. Auto dealers' inventories, largely depleted during the cash-for-clunkers program, have been or are being rebuilt.

Tourism was mixed across those Districts reporting. Travel and tourism--especially leisure travel--was described as robust or improved in the New York, Dallas, and San Francisco Districts. Atlanta and Kansas City characterized tourism as sluggish, while Richmond and Minneapolis described it as mixed; Richmond noted that tourism has been adversely affected by severe and damaging coastal storms, while Kansas City characterized the outlook as "grim." New York indicated that business travel remained sluggish, but Minneapolis and Dallas note a slight pickup.

Nonfinancial Services 비금융 서비스

Activity in the service sector generally picked up since the last report, though results were mixed across Districts and across service industries. New York and Philadelphia reported that service-sector activity overall remained steady to up slightly, while St. Louis noted expanding activity. The information technology industry was reported to be showing improvement in the Boston, Minneapolis, and Kansas City Districts. A pickup in activity at staffing firms was reported by Boston and Dallas, whereas New York noted that activity remained sluggish. Strength in health services was noted in the Boston and Richmond Districts. Shipping activity was characterized as flat in the Cleveland, Atlanta, and Kansas City District, while Dallas reports some gain; however, Dallas and Atlanta both noted particular weakness in rail shipping activity. Professional and business support firms reportedly registered some improvement in the St. Louis and Minneapolis Districts but flat to declining activity in Richmond and San Francisco.

Manufacturing 제조업

Most Districts reported mixed to moderately improving manufacturing conditions since the last report. New York, Philadelphia, Cleveland, Minneapolis, Kansas City, and San Francisco all noted modest increases in manufacturing activity within their Districts. Manufacturing conditions in the Boston and Dallas Districts were characterized as mixed, with some improvement noted for biopharmaceuticals companies in Boston and high-tech manufacturing firms in Dallas. By contrast, Richmond and Chicago both reported that manufacturing activity had leveled off since the last report, while activity continued to decline in the Atlanta and St. Louis Districts, although at a somewhat slower pace than the last report. Tighter credit limited the ability of customers to place new orders in the Richmond District, while in the Chicago District, contacts noted a slowdown in the restocking of inventories. Increases in activity related to the transportation industry were cited in the Chicago, St. Louis, Cleveland, and Kansas City Districts, although such activity was mixed in the Dallas District and reported as declining in the San Francisco District. Several Districts noted an uptick in food-related production.

대부분의 지역의 제조업 경기가 점차로 개선되고 있다.

Many Districts reported that their contacts were optimistic about the near-term outlook. Manufacturers in the Boston, New York, Philadelphia, Atlanta, Minneapolis, and Kansas City Districts expected business conditions to improve in the coming months, while producers in the Cleveland District expressed uncertainty about near-term conditions. The outlook in the Dallas District was mixed, with most manufacturers expressing cautious optimism about the near term and construction-related manufacturers expressing pessimism about the future largely due to expectations of prolonged weakness in commercial real estate.

Real Estate and Construction 부동산, 건설

Home sales and construction activity improved across much of the nation, though prices were generally said to be flat or still declining somewhat. A majority of Districts reported that the lower-priced segment of the housing market has outperformed the high end. Increases in sales activity were reported in the Boston, Cleveland, Richmond, Atlanta, Chicago, Minneapolis, Kansas City, Dallas, and San Francisco Districts, whereas sales were described as steady or mixed in the New York and Philadelphia Districts. Multifamily housing markets deteriorated further in the New York and Chicago Districts. More broadly, a number of eastern Districts reported continued declines in home prices--specifically, Boston, New York, Philadelphia, and Richmond. In contrast, prices were said to have firmed somewhat in the Dallas and San Francisco Districts and stabilized in the Chicago and Kansas City Districts. Most reports maintained that the lower end of the market has outperformed the higher end: New York, Philadelphia, Richmond, Atlanta, Minneapolis, and Kansas City all noted relative weakness at the high end of the market, with relative strength at the lower end; in most cases, this strength was largely attributed to the homebuyer tax credit (which was recently reinstated and expanded to include existing owners).

주택 판매와 건설은 전지역에서 점차 개선되고 있으나, 가격은 안정화되어 있고, 소폭 하락한 흐름도 있다.

Despite the firming in sales, the level of new residential construction activity was generally characterized as weak, though recent trends have been mixed--Atlanta, Kansas City, and Dallas noted some pickup in home construction, whereas the Chicago and St. Louis Districts reported declines. Residential construction was described as flat or stabilizing by Cleveland, Minneapolis, and San Francisco.

Commercial real estate conditions were widely characterized as weak and, in many cases, deteriorating further. Market conditions were reported to have weakened in virtually all Districts, with rising vacancy rates, downward pressure on rents, and little, if any, new development. Expectations for 2010 were also quite low. Boston characterized the commercial real estate outlook as "bleak," Dallas noted that construction was at "historically low levels," and Kansas City described the sector as "distressed." Still, some Districts noted scattered signs of encouragement: Cleveland and Chicago referenced public-works projects as a source of increased business, Richmond noted signs of increased leasing activity from the health and education sectors, Atlanta indicated a modest pickup in new development projects, Minneapolis noted some recently started hotel and retail development, and San Francisco cited slight improvement in availability of financing for new development.

상업용 부동산은 여전히 침체해 있다.

Banking and Finance 은행, 금융

Banks reported steady to softer conditions in most Districts. Loan demand was said to have weakened in the New York, Philadelphia, Cleveland, St. Louis, Kansas City, and Dallas Districts. New York noted particular weakness in demand for home mortgage loans, whereas Richmond and St. Louis reported this to be the strongest segment of late. For the most part, the weakness appears to have been concentrated in the commercial sector, though Boston and Chicago reported some pickup in commercial real estate lending--largely refinancing. Credit quality showed signs of deteriorating in the New York, Philadelphia, Dallas, and San Francisco Districts but was described as stable or mixed in Cleveland, Chicago, and Kansas City, with Chicago reporting some improvement outside of commercial real estate. Increasingly tight credit standards were reported in the New York, Richmond, Chicago, St. Louis, Dallas, and San Francisco--largely on commercial loans.

Agriculture and Natural Resources 농업, 천연자원

Excessively wet conditions during October and early November were reported in a number of Districts. As a result, the fall harvest was delayed in many parts of the Richmond, Atlanta, Chicago, St. Louis, Minneapolis, and Kansas City Districts. Flooding from Tropical Storm Ida and a November "nor'easter" damaged crops and delayed planting throughout the Richmond District, and Virginia health officials closed fishing in all Chesapeake Bay tributaries and temporarily banned the harvesting of shellfish due to potential storm water contamination. By contrast, rainfall in the Dallas District helped alleviate drought conditions experienced in many parts of the region. Contacts in the Chicago, Minneapolis, and Kansas City Districts noted that corn and soybean prices rallied over the past month, although a wide variation in margins was expected for crop farms due to differences in input costs. Losses for livestock operations occurred in the Chicago and Kansas City Districts.

Most energy-producing Districts reported a slight uptick in activity in extraction industries since the last report. Contacts in the Cleveland, Atlanta, Dallas, Minneapolis, Kansas City, and San Francisco Districts noted steady to increasing oil and natural gas production within their regions, albeit from low levels of production observed earlier this year. Contacts in the Cleveland District also reported that a sharp decline in coal production had leveled out since the last report. In general, oil prices increased somewhat, while reports on the price of natural gas were mixed due in large part to differences in inventory levels across Districts. Mining activity in the Minneapolis District increased.

Employment, Wages, and Prices 고용, 임금, 물가

Labor market conditions remained weak since the last report, with further layoffs, sluggish hiring, and high levels of unemployment in most Districts. However, contacts in the Atlanta, Cleveland, and Richmond Districts reported that the pace of job cuts generally slowed in their regions, and most contacts in the Dallas District reported stable employment levels. Despite generally weak employment conditions, some signs of improvement were noted. For example, contacts in Boston reported that they were beginning to hire and reverse pay cuts or freezes that were implemented earlier in the year, and contacts in the St. Louis District reported that the service sector had started to expand recently. Expectations for the holiday season were mixed across Districts, with contacts in the New York and Dallas Districts reporting lighter-than-normal seasonal hiring and/or increases in the hours of existing employees, as opposed to hiring temporary workers, to meet the seasonal demand. On the other hand, most retailers in the Richmond District have hired the usual number of seasonal workers this year.

노동 시장은 여전히 약세에 머물러 있다.

Districts generally reported little or no upward wage pressures, while some Districts noted upward pressure in commodity prices, and most Districts reported stable selling prices. Wages were largely reported to be holding steady in the Boston, Cleveland, Richmond, Chicago, Minneapolis, Kansas City, Dallas, and San Francisco Districts. Most Districts reported stable prices overall, although some reported higher input prices, largely for energy and other commodities used in production, with a limited ability to raise selling prices. Prices were reported as moderately lower in the Kansas City District, and downward price pressures were cited for some professional services and intermodal transportation firms in the Dallas District. Some makers of food products and chemicals in the Philadelphia District reported raising prices, and the prices of computer memory chips continued to firm in the San Francisco District. Retailers in several Districts indicated that they have managed inventory levels in an effort to prevent the steep price discounting that occurred last year, however, some promotional price discounting is expected through the holiday season.

임금인상 압박은 거의 없다. 상품 물가는 소폭 인상 압박이 있다.

| 2009 | |||||

|---|---|---|---|---|---|

| January 14 HTML 183 KB PDF |

February |

March 4 HTML 187 KB PDF |

April 15 HTML 253 KB PDF |

May |

June 10 HTML 232 KB PDF |

| July 29 HTML 276 KB PDF |

August |

September 9 HTML 166 KB PDF |

October 21 HTML 289 KB PDF |

November |

December 2 HTML 291 KB PDF |

[관련글]

2009-10-21 미국 베이지북 2009년 10월호

2009-11-23 미국 10월 기존주택판매

'Market(o)' 카테고리의 다른 글

| 주가 하락 어떻게 볼 것인가? 주식시장, 지수 변동성의 이해 (0) | 2010.02.05 |

|---|---|

| 주식 투자는 몇 월부터 시작하는 것이 좋을까? (2) | 2010.01.14 |

| 미국 10월 기존주택판매 557만채 증가 _09.11.23 (0) | 2009.11.24 |

| 미국 실업률, 주간 실업청구건수 변화, 노동자 평균임금 _1948~2009.11 (1) | 2009.11.20 |

|

| |||||

fullreport20091202.pdf

fullreport20091202.pdf