|

|

||||

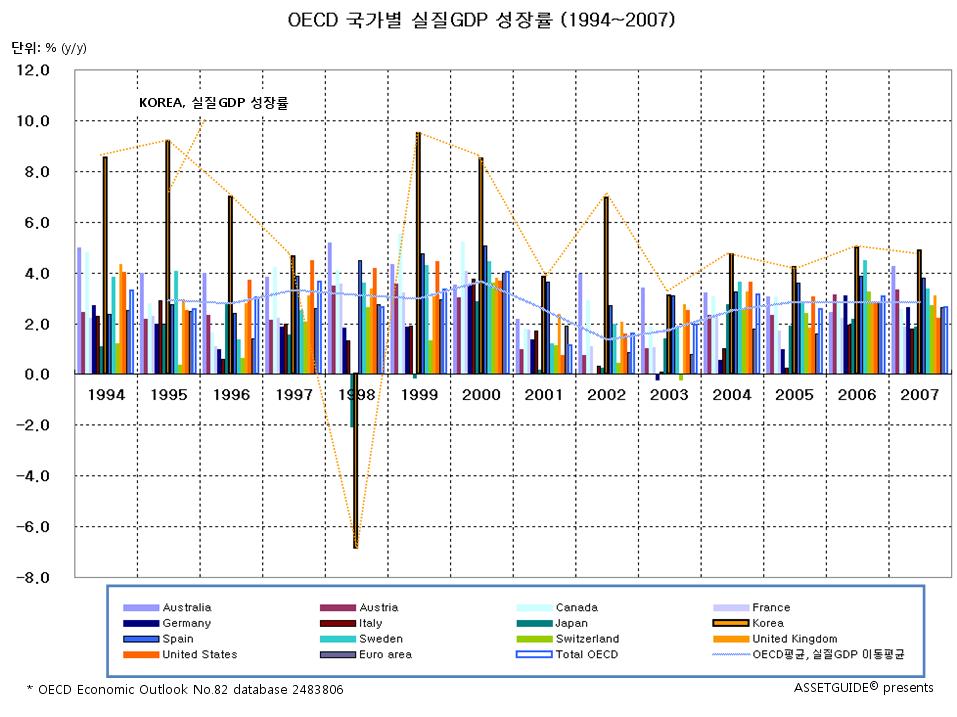

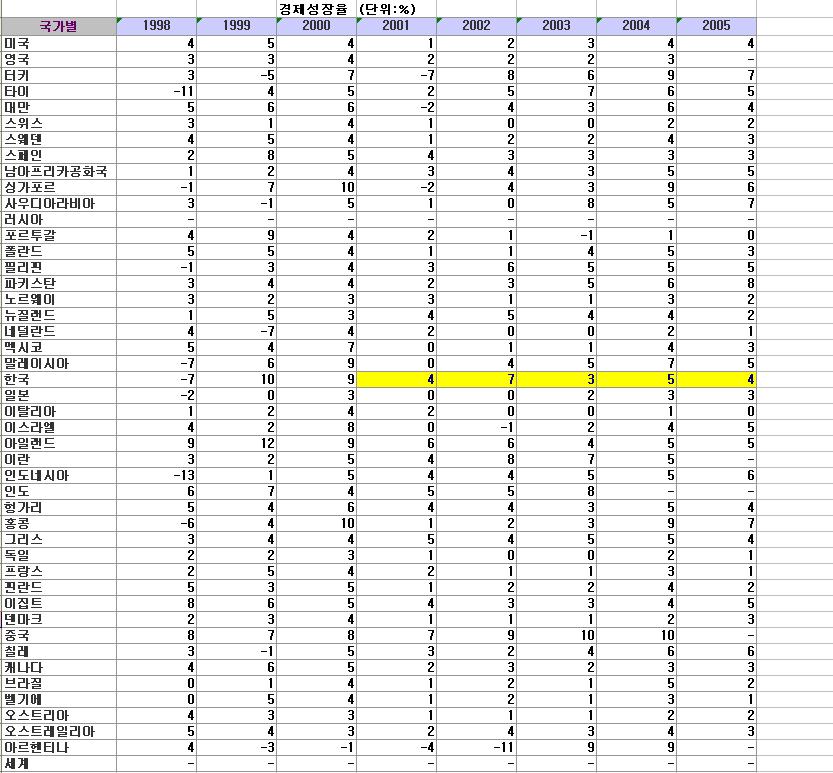

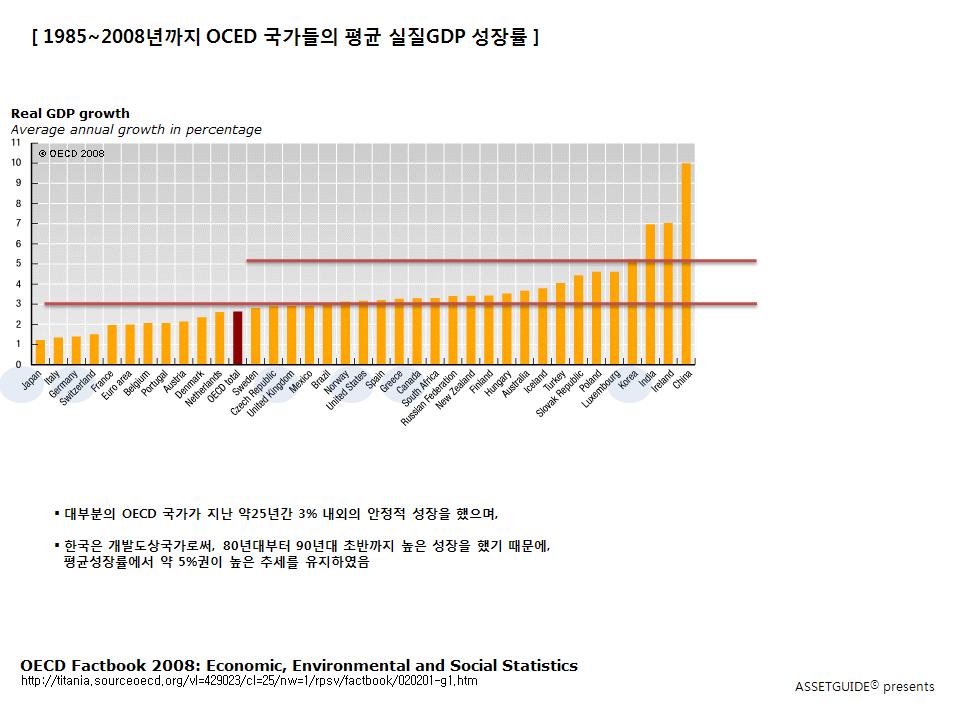

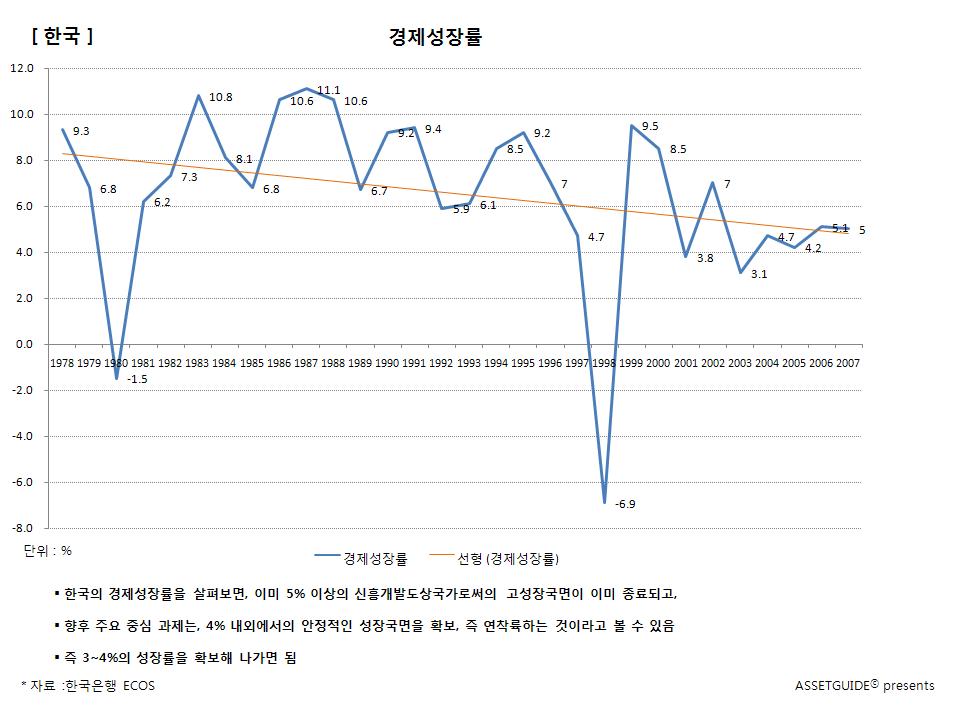

OECD는 2009년 3월 31일(현지) Interim Report를 통해, 2009년 주요 OECD 국가의 경제성장률이 -4.3% 역성장하고,

2009년 한 해 실업률이 급격히 올라가서, 미국 실업률의 경우 10% 상향 돌파할 것으로 전망했습니다.

(그림을 클릭하면 잘 나옵니다.)

OECD는 이러한 글로벌 경제 위기를 극복하기 위해서는, 정부가 다음의 8가지 정책 영역에서 바른 행동을 취하며 끈기있게 노력해야 한다고 권고했습니다.

To sum up, governments -- individually and collectively -- will have to persevere in doing the right thing in eight policy areas. These are:

i) address even more forcefully the lingering financial crisis by adopting the measures required to stabilise systemically important institutions, reduce market uncertainty and illiquidity, and restart bank lending. This implies removing toxic assets and promoting bank recapitalisation; if necessary, by nationalisation;

금융위기에 적극 대응하고, 시장 불확실성을 축소하고 유동성을 보강할 것

ii) in those countries that still have room to manoeuvre, continue monetary and fiscal easing as the recession deepens;

통화정책, 재정정책 완화를 계속할 것

iii) avoid disguised trade protection measures in the form of support and subsidies of domestic real-sector firms, both during the crisis and afterwards;

변칙적 무역보호 조치를 피할 것

iv) once sustained recovery is attained, be prepared to reverse quickly and forcefully financial emergency measures, as well as fiscal and monetary stimulus, to ensure medium-term macroeconomic and financial stability;

회복단계에 들어서면 조속히 거시경제 재정 안정성을 도모하기 위한 조치를 준비할 것

v) work hard together to reach an internationally-agreed global framework for better financial-market regulation and supervision;

보다 향상된 글로벌 금융시장 규제와 감독을 위해 상호 협력할 것

vi) counter-cyclicality of bank behaviour should be strengthened by adopting adequate macro-prudential regulation, complemented by strongly counter-cyclical fiscal and monetary policy rules;

은행 감독에 대한 보다 철저한 강화

vii) continue the drive toward world trade integration, both unilaterally and multilaterally through completion of the Doha Round, while ensuring further integration of world financial markets; and

글로벌 금융시장 통합을 확인하면서, 도하라운드를 통한 세계무역통합 지속

viii) pursue structural reforms to make domestic product and labour markets more competitive in order to raise long-term growth prospects and strengthen resilience to adverse shocks.

내수 및 노동시장을 보다 경쟁력있도록 하기 위한 구조적 개혁을 추구한다.

다음은 주요 내용입니다. (출처 : OECD)

GDP to plummet 4.3 percent across OECD countries in 2009 as unemployment climbs sharply

Tuesday 31 March, 11.00

31/03/2009 - Economic activity is expected to plummet by an average 4.3 percent in the OECD area in 2009 while by the end of 2010 unemployment rates in many countries will reach double figures for the first time since the early 1990s, according to the OECD’s Economic Outlook Interim Report.

Amid the deepest and most widespread recession for more than 50 years, international trade is forecast to fall by more than 13 percent in 2009 and world economic activity to shrink by 2.7 percent. The big emerging economies will also suffer abrupt slowdowns in growth.

The global recession will worsen this year before a policy-induced recovery gradually builds momentum through 2010, the report says.

In the United States, activity will fall sharply in the near term, but the country could begin to pull out of the recession in early 2010, assuming the effectiveness of strong stimulus packages and more stable financial and housing markets. Gross domestic product (GDP) is forecast to fall 4.0 percent in 2009 then remain unchanged next year.

In Japan, economic output is projected to fall by 6.6 percent this year as shrinking export markets more than offset policies to encourage domestic spending. Deflation will return as spare capacity puts downward pressure on prices. The fall in output in 2010 is expected to be 0.5 percent as internal demand picks up in the second half of the year.

Weak export markets, falling investment and a continuing credit crunch will hit Euro area activity hard over the coming six months. The recovery will only begin to build momentum by the middle of 2010. GDP is projected to drop 4.1 percent in 2009 and by 0.3 percent next year.

In the large emerging economies activity is slowing as access to international credit dries up, commodity prices fall and export demand weakens. Brazil’s GDP is expected to decline by 0.3 percent in 2009 while Russia’s is projected to fall 5.6 percent. Growth in India will ease back to 4.3 percent this year and in China to 6.3 percent.

The Interim Outlook adds that the risks of an even gloomier scenario outweigh the possibility of a quicker recovery. The most important risk is that the weakening real economy will further undermine the health of financial institutions, which in turn deepens the slump in economic activity.

The report finds that the discretionary stimulus measures taken by governments in response to the crisis will on average boost GDP by around 0.5 percent in 2009 and in 2010. The United States and Australia are exceptions in that their discretionary measures are estimated to increase GDP by more than 1.0 percent for both years. These estimates are taken into account in the Interim Economic Outlook’s forecasts.

How effective the measures will be also depends on timing. The Interim Economic Outlook recommends that those countries that have scope for further action should consider boosting the stimulus in 2010 then, as the recovery strengthens, they should scale back or even reverse the measures in order to strengthen public finances over the long-term.

=> For more information, visit www.oecd.org/oecdeconomicoutlook

OECD Area, Growth has collapsed

The downturn is the most severe and synchronised in post-war history

Bank credit default swap rate

The collapse of world trade growth cannot be explained by past relationships

World trade growth has plummeted

Real house prices are falling in virtually all countries

The cycle is globale, Oecd growth

The OECD output gap will be the largest in four decades

Governments have introduced a wide array of financial relief measures since mid 2008

'Market(o)' 카테고리의 다른 글

| 4월 금통위 금리 전망 _2.0% 현행수준 동결전망 _2009.04 (0) | 2009.04.04 |

|---|---|

| G20 정상회의 런던 선언문 전문 _09.04.02 (0) | 2009.04.03 |

| 2009년 산업활동동향 월별 공표 일정 _통계청 (0) | 2009.03.31 |

| 2009년 2월 산업활동동향 _경기선행지수, 경기동행지수,광공업생산지수 _통계청 (0) | 2009.03.31 |

|

| |||||

맞춤검색

42443150.pdf

42443150.pdf